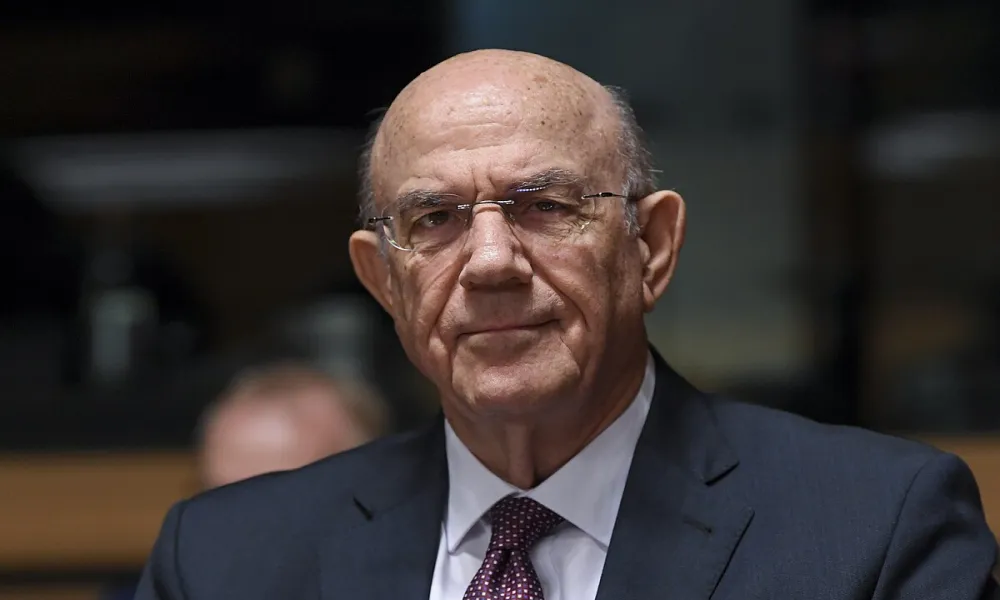

Cyprus Finance Minister Makis Keravnos has made it clear he won’t submit a watered-down version of the long-awaited tax reform, even hinting at withdrawing the proposal entirely if Parliament introduces excessive amendments.

Speaking to reporters following Wednesday’s Cabinet meeting, Keravnos emphasized his commitment to a comprehensive and meaningful overhaul of the tax system, the first in 23 years. He stressed that the reform must serve the interests of the middle class, ordinary workers, taxpayers, and Cypriot businesses.

“I will not table a compromised reform that fails to deliver real change,” he said. “If Parliament alters its essence, I’m prepared to pull it altogether.”

Broad Consultation, Strong Support

According to the Minister, the proposed tax changes are the result of extensive public and private consultations, arguably the most far-reaching dialogue ever held on a policy matter in Cyprus. Stakeholders such as the Cyprus Employers and Industrialists Federation (OEB), the Chamber of Commerce (KEVE), and other professional bodies have been actively involved.

“There’s significant alignment on key issues,” Keravnos noted, adding that certain reactions from specific quarters appear to undermine progress for political gain. “We must stop sabotaging forward-looking ideas that are broadly acknowledged as positive for our economy.”

September 15: A Critical Meeting

The Finance Minister confirmed he will reconvene with parliamentary party leaders on September 15 to revisit the proposal. He expressed openness to constructive input.

“I welcome positive ideas and solutions. If something valuable has been overlooked, I’m ready to adopt it.”

Responding to Criticism

When asked about criticism from Fiscal Council President Michalis Persianis, who accused the reform of lacking vision, Keravnos didn’t mince words:

“I’m not concerned with fantasies. If others have visionary proposals, they’re welcome to share them.”

Key Objectives of the Reform

Keravnos outlined the core goals of the reform:

-

Fairer tax distribution

-

Relief for the middle class

-

Boosting domestic entrepreneurship

-

Incentivizing compliance and fighting tax evasion

One major shift includes reducing the 17% defence tax for Cypriot businesses to just 5%, offering what Keravnos described as “real relief” for local enterprises.

Additionally, the government aims to maintain, and even strengthen, the tax regime for foreign companies, helping preserve Cyprus’s reputation for economic resilience and growth, currently among the strongest in the EU.

No Police State, But No Tolerance for Tax Dodgers

Keravnos emphasized that the reform is aligned with EU law and has been reviewed by European legal experts. The goal is not to intimidate, but to ensure tax fairness.

“We’re not creating a police state. But we are determined to tackle tax evasion and avoidance, which, according to University of Cyprus estimates, could reach up to 25%.”

In closing, the Minister assured law-abiding citizens and businesses that they have nothing to fear, but warned that loopholes enabling unfair advantage would no longer be tolerated.

With information from CNA