Alcohol prices across Europe vary dramatically, and Cyprus is positioned near the European average according to the latest comparative data. While the island does not fall into the extremes of either the highest-priced or the cheapest markets, the new figures highlight how differently alcohol is taxed, priced and consumed across the continent — differences that also influence purchasing habits locally.

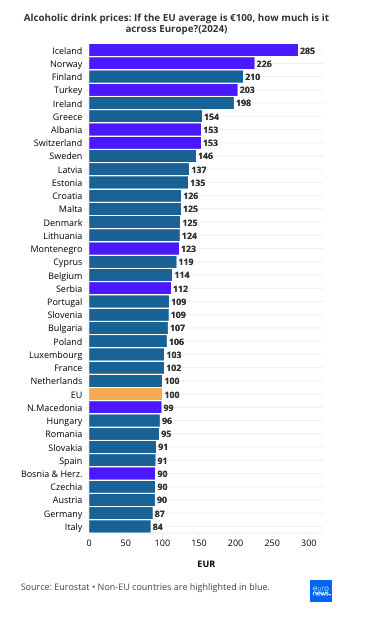

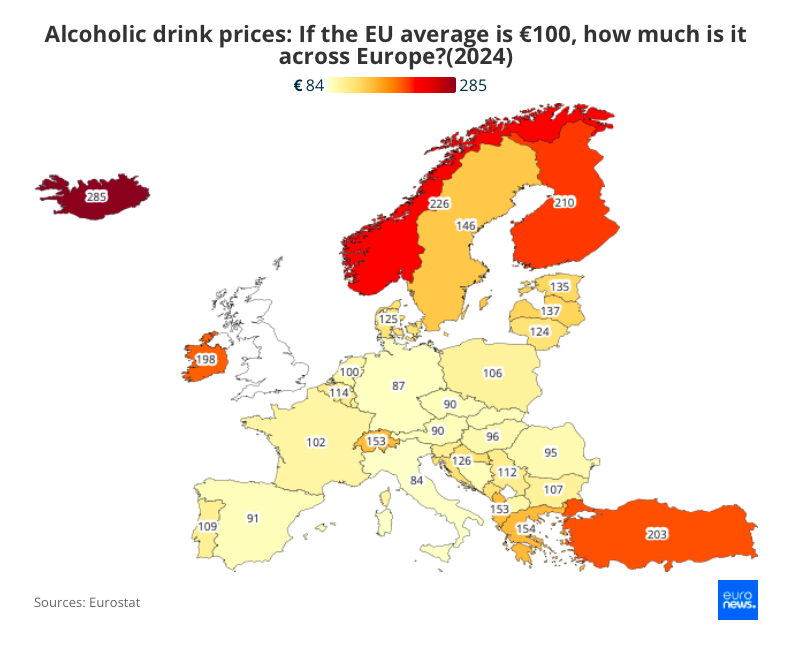

Eurostat’s price level index, which compares the cost of the same basket of alcoholic drinks across 36 European countries, sets the EU average at 100. Countries scoring above that threshold have higher prices relative to the EU norm; those below are comparatively cheaper. Cyprus sits close to the midpoint of the table, offering valuable context for understanding how Europe’s pricing dynamics shape local consumer behaviour.

Nordic countries top the list

In 2024, Iceland emerges as the most expensive country for alcohol, with a basket of drinks costing €285 compared with the EU reference of €100. Norway (€226), Finland (€210) and Turkey (€203) also exceed twice the EU average, while Ireland (€198) follows closely. Sweden (€146) and Denmark (€125) remain well above the European baseline, reflecting long-standing public-health-focused tax regimes.

Southern Europe remains the cheapest

Toward the lower end, Italy (€84), Germany (€87) and Austria (€90) offer some of the most affordable alcohol prices in Europe. Spain (€91) is also below the EU average. Among major economies, only France (€102) sits slightly higher than the continental benchmark.

Why these differences exist

Although the index shows major disparities in retail prices, it does not measure affordability, since incomes and household purchasing power vary widely. As Professor Colin Angus from the University of Sheffield notes, a country with low prices may still have low affordability if incomes are also lower.

Mediterranean countries, by contrast, generally have lower consumption rates and apply more modest tax levels.

Taxation is widely seen as the primary driver of price differences. Northern European countries typically impose higher taxes on alcohol due to historically higher consumption levels and efforts to reduce alcohol-related harm. In its last year of comparison (2020), the UK recorded an index of 139, also above the EU average.

Tax policy, production, and revenue

Excise taxes form a major part of the retail price, especially for beer, wine and spirits. In 2020, the highest tax shares for beer were found in Finland, Turkey, Norway, Estonia and Iceland, ranging from 28 to 39 percent. For spirits, taxes can exceed half the final price. In low-tax countries, the equivalent share can fall below 10 percent.

Tax increases can reduce harmful drinking while simultaneously raising government revenue.

Production also plays a role: wine-producing countries often apply minimal or no tax on wine, while non-producing countries tend to tax it more heavily.

Taken together, these factors create a European alcohol landscape of striking contrasts — one that sets the context for Cyprus’ own pricing environment and consumer patterns.